More Information

ABOUT CA:

CA) Chartered Accountant is considered one of the best career paths and has been pursued by the students who find themselves comfortable at numbers. The chartered accountant is an international accounting designation granted to accounting professionals, they can give advice, audit accounts and provide trustworthy information about financial records.

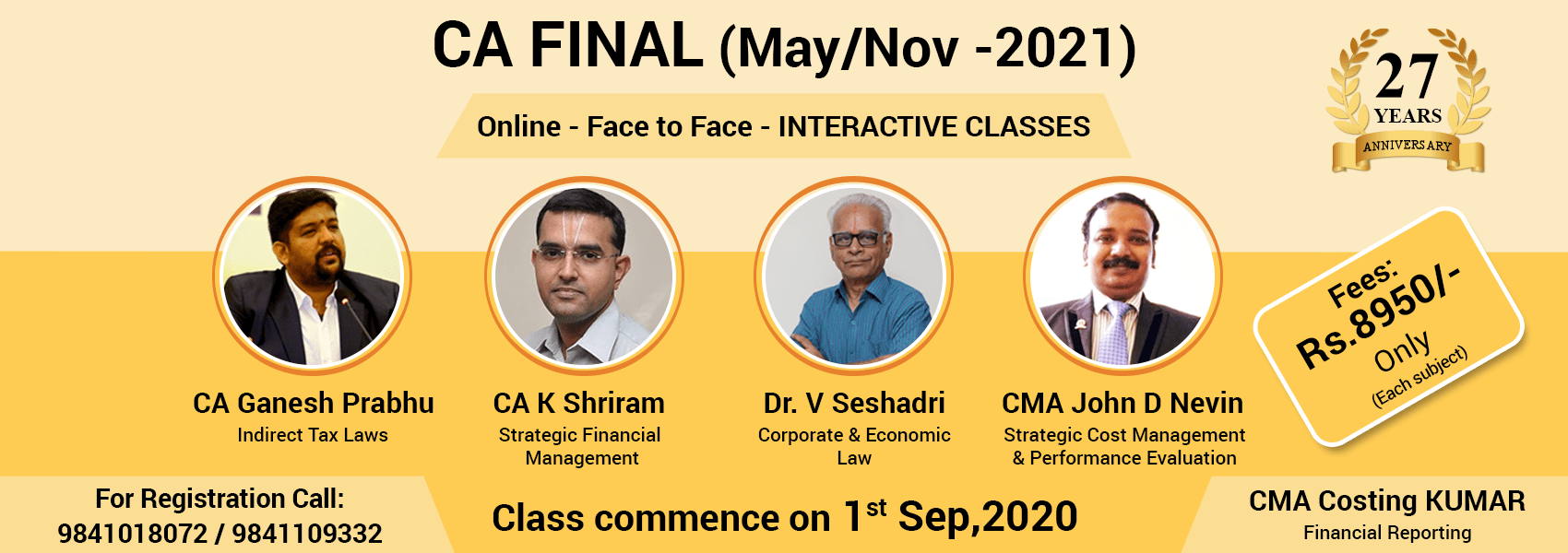

ABOUT CA-FINAL:

CA Final Examination is the last and final level of Chartered Accountancy Examinations. Any person who has passed both the groups of IPCC can take up the final examinations during the last 6 months of articleship. This exam consists of two groups consisting of four subjects each.Admission is open throughout the year.It is to gain ability to analyze financial statements and financial reports of various types of entities, to apply financial management theories and techniques for strategic decision making, to gain expert knowledge of current auditing practices and procedures and apply them in auditing engagements, to analyze and apply various provisions of the Company Law & allied law in practical situations.

There are 8 subjects to be studied arranged into 2 groups of 4 papers of 100 marks each i.e. a total of 6 papers if 100 marks each.To pass a student has to obtain a minimum of 40% in each paper and an aggregate of 50% in all the papers of both the groups together if attempting both the groups or all the papers of a single group, failing which the student has to reappear in all the papers of that group/groups again.

GROUP I

- Financial Reporting

- Strategic Financial Management

- Advanced Auditing & Professional Ethics

- Corporate & Economics Laws

GROUP II

- Strategic Cost Management & Performance Evaluation

- Elective Paper

- Direct Tax Laws & International Taxation

- Indirect Tax Laws

| GROUP-1 | |

|---|---|

| Subjects | Faculty |

| Financial Reporting | Prof. Costing KUMAR |

| Strategic Financial Management | Prof. Costing KUMAR |

| Corporate & Economic Laws | CA B GANESH PRABHU |

| GROUP-2 | |

|---|---|

| Subjects | Faculty |

| Strategic Cost Management and Performance Evaluation | Prof. Costing KUMAR |

| Direct Tax Laws & International Taxation | CA CRV PRASAD |

| Indirect Tax Laws | CA B GANESH PRABHU |

ELIGIBILITY:

- The candidate must have passed the Intermediate Examination.

- The candidate must have obtained Final Course registration number from Board of Studies Section of the concerned decentralized office of the Institute after passing the Intermediate Examination.

- The candidate must have completed the practical training as is required for admission as a member or is serving the last twelve months of practical training on the first day of the month in which the examination is scheduled to be held: and

NOTE: The candidate is advised in his own interest to satisfy himself/herself that he/she is re-registered immediately for training for the excess leave period if any, as on the date of filling up the examination form and before the commencement of examination (as applicable). In other words a candidate must have either completed the training or must be in service as on the first day of the month in which the examination is to be held and the balance period of training must not be more than twelve months including excess leave, if any.

FEE STRUCTURE:

CA FINAL -: ₹ 12,900 /- (*Excl. GST 18%) (For Each Subjects)

Contact us for Fee information

044-42068425 / 9941298973 / 9841109332 / 9841018072

HOW TO MAKE PAYMENT:

Payment by demand draft

Paste your photograph and Send the filled Form with D.D (Favoring RR Academy Coaching Centre, Payable at Chennai) and superscribing the envelope with the words “Enrolment for CPT/IPC/FINAL-BATCH xx” to our office by courier / speed post.

Payment by Cash

Paste your photograph and walk in to our office premises with the CASH for registering to the desired batch.

Please bring one passport size photograph at the time collecting ID Card.

Submit /Send the Application with CASH/ DD then click “REGISTRATION CONFIRMATION” link after 7 days to get your confirmation number.