More Information

ABOUT CA:

CA) Chartered Accountant is considered one of the best career paths and has been pursued by the students who find themselves comfortable at numbers. The chartered accountant is an international accounting designation granted to accounting professionals, they can give advice, audit accounts and provide trustworthy information about financial records.

ABOUT CA-INTER:

This is the identification for the second level of the CA (Chartered Accountancy) course conducted by the ICAI (Institute of Chartered Accountants of India). The course is identified as IPCC (Integrated Professional Competence Course) and the examination at the end of the course is identified as IPCE (Integrated Professional Competence Examination) This is the second level for all students taking up the chartered accountancy course after getting through the CA CPT (Chartered Accountancy Common Proficiency Test).

DUE DATE FOR CA – IPCC

Last Date for CA IPCC Registration for May attempt : 28th Feb

Last Date for CA IPCC Registration for November attempt : 31st Aug

SUBJECTS COVERED IN CA INTER COURSE

Group I

- Accounting

- Corporate & Other Laws

- Cost &Management Accounting

- Taxation (DT & IDT)

Group II

- Advanced Accounting

- Auditing & Assurance

- Enterprise Information Systems & Strategic Management

- Financial Management & Economics for Finance

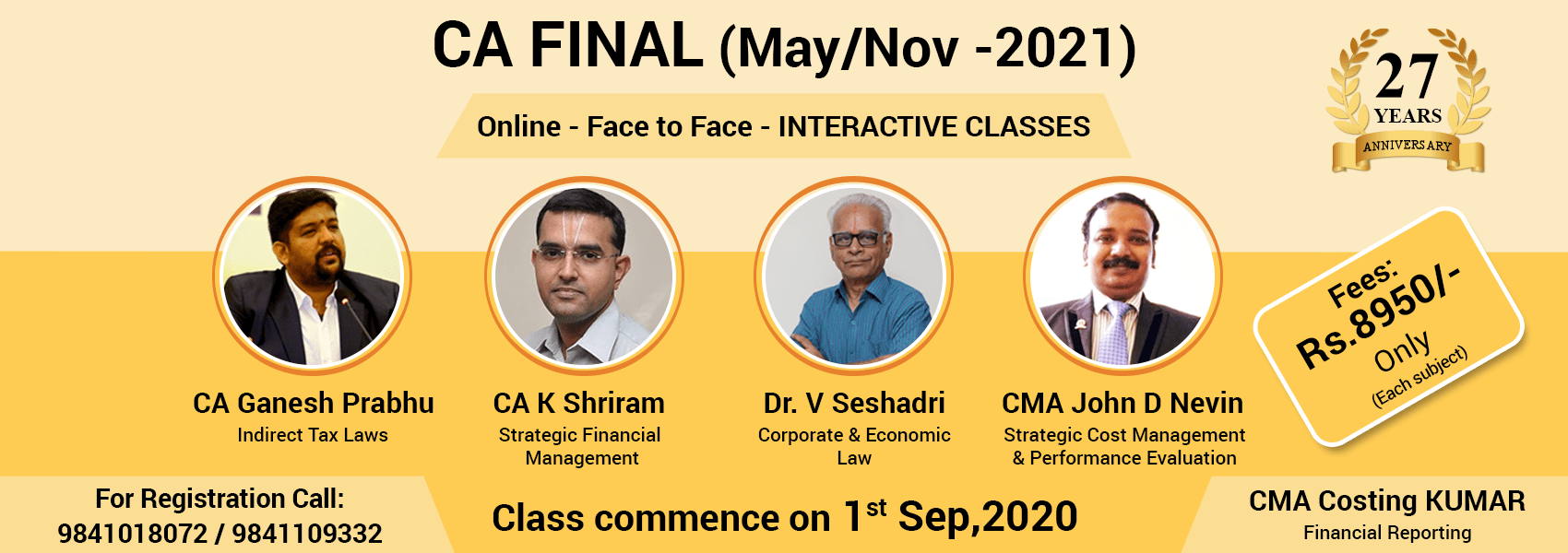

| GROUP-1 | |

|---|---|

| Subjects | Faculty |

| Accounting | Prof. Costing KUMAR |

| CA K SHRIRAM | |

| Corporate & Other Laws | Dr. V.SESHADRI |

| Cost and Management Accounting | Prof. Costing KUMAR |

| Taxation | CA CRV PRASAD |

| CA B GANESH PRABHU | |

| GROUP-2 | |

|---|---|

| Subjects | Faculty |

| Advanced Accounting | Prof. Costing KUMAR |

| CA K SHRIRAM | |

| Auditing and Assurance | CA S KARTHICK |

| Enterprise Information Systems & Strategic Management | Prof. R SRINIVAS |

| Dr. LN | |

| Financial Management & Economics for Finance | Prof. Costing KUMAR |

ELIGIBILITY:

- A candidate becomes eligible to register for Intermediate only after passing (10+2) examination conducted by an examining body constituted by law and also after passing CPT (Common Proficiency Test) or CA Foundation (introduced by ICAI as per the new scheme).

- There is also a direct entry route through which a candidate can enroll for Intermediate directly without going through Either CPT or CA Foundation.

- Students who are Graduate/ Post Graduate in Commerce and secured a minimum of 55% can register directly for Intermediate without passing CA Foundation or CPT.

- Similarly like Commerce Graduates, Non commerce Graduates/ Post Graduates can also register for Intermediate by securing 60% marks in Graduation/ Post Graduation.

- Apart from the above, the students who cleared the Intermediate level of the Institute of Cost Accountants of India or The Institute of Company Secretaries of India.

- The above students can get register directly for the Intermediate level without passing entrance level.

- The students who are appearing in the Intermediate examinations through the Foundation route are required to undergo 8 months of study period after registering for Intermediate Course.

- The candidates who are there in the last year of their graduation can register for the Intermediate course on the Provisional basis.

- However, they can commence practical training only on the successful submission of the proof that they have passed their graduation successfully with the specified percentage discussed above. During this provisional registration period, they can complete ITT (Information Technology) and O.P (Orientation Programme). But if they failed to produce such evidence then their provisional registration shall stand canceled and fees will neither be refunded nor be adjusted. Addition to this, if he has undergone through theoretical Educational Programme then no credit shall be given of such.

- ITT and OP training must be completed before commencement of practical training for the graduate students / Post Graduate students who are taking direct entry in the CA Course.

- And in order to appear in the Intermediate examination, they need to successfully complete nine months of practical training.

- However, the candidates who are registered directly in the CA Intermediate after clearing the Intermediate level of “The Institute of Cost Accountants of India” or “The Institute of Company Secretaries of India” are eligible to appear in the Intermediate examination after undergone through 8 months of study period similar like students who are appearing through the CA Foundation route.

FEE STRUCTURE:

Fees :

CA INTER – 34,500 (*Excl.GST 18%) (For Each Group)

Contact us for Fee information

044-42068425 / 9941298973 / 9841109332 / 9841018072

HOW TO MAKE PAYMENT:

Payment by demand draft

Paste your photograph and Send the filled Form with D.D (Favoring RR Academy Coaching Centre, Payable at Chennai) and superscribing the envelope with the words “Enrolment for CPT/IPC/FINAL-BATCH xx” to our office by courier / speed post.

Payment by Cash

Paste your photograph and walk in to our office premises with the CASH for registering to the desired batch.

Please bring one passport size photograph at the time collecting ID Card.

Submit /Send the Application with CASH/ DD then click “REGISTRATION CONFIRMATION” link after 7 days to get your confirmation number.